By: Rachelle F. Berger | VP Business Development

Date: October 10th, 2024

Reflecting on the early days of my career, it is remarkable to consider how a seasonal teller position during my first year of college sparked a journey spanning more than 30 years in the financial services industry. That role introduced me to the world of banking, setting the stage for a rewarding career that has brought me to my current position as Vice President of Business Development at Midwest Loan Services. Every step along the way has contributed to my growth, and I feel deeply grateful for the experiences and lessons learned.

seasonal teller position during my first year of college sparked a journey spanning more than 30 years in the financial services industry. That role introduced me to the world of banking, setting the stage for a rewarding career that has brought me to my current position as Vice President of Business Development at Midwest Loan Services. Every step along the way has contributed to my growth, and I feel deeply grateful for the experiences and lessons learned.

Throughout my career, I have gained extensive experience across a wide range of roles in banking and lending. From mortgage origination to branch management, private banking, and commercial banking, each role has provided valuable insights into client needs and the importance of personalized service, which I now apply to mortgage servicing and mortgage subservicing. I have had the opportunity to work in lending and loan servicing for both banks and credit unions, learning everything I could in each position. I believe I have handled nearly every type of loan there is!

When I was presented with the opportunity to join Midwest Loan Services, it felt like the perfect fit. After many years of working with individual consumers and small businesses, I embraced the opportunity to shift my focus to supporting financial institutions. What appealed to me most about working for Midwest was the chance to apply my experience in a way that would help credit unions and mortgage lenders navigate the complexities of mortgage servicing. I saw a clear alignment between my background and the needs of the financial institutions we serve, and I knew that my diverse experience would allow me to connect with clients on a deeper level.

At Midwest Loan Services, a leading mortgage subservicer, we provide the tools and expertise our clients need to succeed while maintaining operational efficiency. Our company’s size allows us to offer comprehensive solutions without sacrificing the personalized service that sets us apart in the mortgage subservicing industry. Understanding the unique challenges our clients face is essential to providing effective mortgage subservicing solutions, and that understanding motivates me every day.

One of the most fulfilling aspects of my role is witnessing the impact that quality subservicing can have on our clients. Mortgage servicing is very complex, time-consuming, and uses many resources. By partnering with Midwest, banks, credit unions and mortgage lenders are able to improve efficiency, reduce risk, and enhance borrower satisfaction. Subservicing allows them to focus more time and resources on their core operations, growth, and serving their members or customers. It is particularly rewarding when clients share with me how subservicing with Midwest has helped them streamline their processes, alleviate stress for their team, and improve the quality of service they provide.

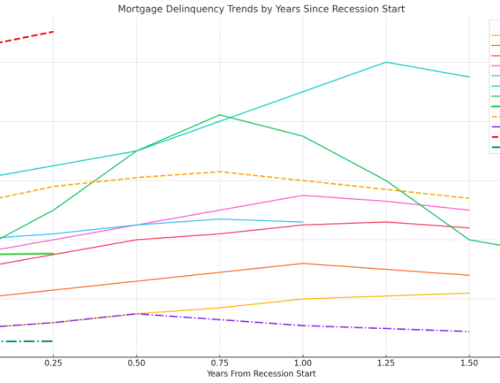

Of course, the mortgage servicing industry presents its own challenges. Economic factors, interest rates, and shifts in mortgage volume all influence the needs of our clients. These fluctuations require us to be responsive and agile. Furthermore, the regulatory landscape is constantly evolving, and financial institutions must remain compliant while managing competing priorities. It is not uncommon for some initiatives to take months, even years, to reach fruition. However, the patience and perseverance needed to navigate these hurdles are well worth it when a client is ready to move forward. I take pride in knowing that the solutions we offer as a mortgage subservicer make a lasting difference for our clients.

What I enjoy most about my role at Midwest Loan Services is building relationships. I have always been motivated by a desire to help people and address their unique challenges. In my current position, I have the privilege of guiding potential clients through the entire process, from the initial presentation to contract review and signing. Once a client has partnered with us, I remain actively involved to ensure we continue to meet their needs and exceed their expectations. Trust is the cornerstone of every partnership, and I believe that open, honest communication is vital to maintaining strong, lasting relationships. At Midwest Loan Services, we are committed to delivering exceptional service at every stage of the client journey, whether we are supporting credit unions, banks, or mortgage lenders.

The culture at Midwest Loan Services supports this client-focused approach. Our commitment to client satisfaction is matched by a dedication to creating an environment where employees feel respected, valued, and empowered to excel. I am consistently impressed by the professionalism and dedication of our staff, and I am reassured daily that our clients and their borrowers are in capable hands. This confidence in our team allows me to perform my role with assurance, knowing that we are delivering on our promises.

Midwest Loan Services also encourages internal growth and values employee feedback. The company’s promotion-from-within culture ensures that we have a team that is not only experienced but also deeply committed to the company’s success. I consider myself fortunate to work for a company that shares my values and provides the resources and support necessary for success. Our clients’ achievements are a direct reflection of the care and effort we put into our work, and I see that commitment every day at Midwest Loan Services.

A memorable experience early in my time at Midwest was attending my first mortgage conference in 2022. It gave me the chance to connect with clients and industry partners, whose positive feedback reinforced my decision to join Midwest Loan Services. Hearing how our work supports our clients’ success strengthened my commitment to the company and its mission.

As I look back on my journey, I feel a deep sense of fulfillment and pride in the work I have been able to do. I have had the privilege of working with remarkable clients and colleagues, and I am proud to be part of Midwest Loan Services. Our commitment to providing outstanding mortgage servicing solutions remains a cornerstone of my professional philosophy. If you are seeking a mortgage subservicer that understands the unique demands of the mortgage industry and can deliver reliable results, I invite you to explore what we can achieve together. My journey has been immensely rewarding, and I look forward to continuing to make an impact at Midwest Loan Services.