By: Kelly O’Bannon | EVP, Business Development

Date: February 5th, 2025

Mortgage servicers grappling with escalating costs now face a pivotal choice: adapt or risk eroding profitability. For credit unions, community banks, and financial institutions, rising mortgage servicing expenses threaten borrower satisfaction, operational stability, and long-term growth. Yet, proactive strategies exist. Outsourcing to a specialized mortgage subservicer like Midwest Loan Services can slash overhead, simplify compliance, and refocus teams on core priorities. In this post, we dissect the drivers of today’s cost crisis—from regulatory complexity to default management—and reveal how automation, digital tools, and strategic partnerships can transform burdensome workflows into competitive advantages. Discover actionable steps to protect margins, boost efficiency, and future-proof your institution.

The Rising Costs of Mortgage Servicing

Mortgage servicing, the process of managing loans after origination, encompasses payment processing, customer support, compliance, and default management. While essential, these tasks have grown increasingly complex and costly. According to the Mortgage Bankers Association’s (MBA) 2023 Servicing Operations Study, rising expenses are eroding lenders’ financial health and operational performance.

Breaking Down the Costs

- Performing Loans: These costs encompass day-to-day activities like payment processing, customer service, compliance monitoring, operational overhead, and systems upkeep. In 2023, these expenses reached an average of $176 per loan, up from $168 in 2022. This translates to approximately $14 to $15 per month per loan and illustrates the considerable resources required even for performing loans.

- Non-Performing Loans: When loans become delinquent, costs rise sharply. Servicing these loans involves additional expenses like collections, loss mitigation, legal fees, property management, and foreclosure processes. In 2023, the cost of servicing non-performing loans surged to $1,857 per loan, up from $1,808 the year prior. This averages between $151 to $155 per loan per month.

These figures underscore the disproportionate strain of delinquent loans and the urgent need for cost-effective solutions.

Reasons Behind Rising Costs

Understanding the drivers behind rising expenses is key to addressing them.

For Performing Loans

- Increased Servicing Complexity: Changes in regulations and compliance requirements, such as those stemming from the Dodd-Frank Act, have added layers of complexity to servicing operations. The additional costs of maintaining records, reporting, and ensuring compliance drive the expense of servicing your loans.

- Specific Functional Area Expense: Higher expenses in specific functional areas are directly contributing to the increased costs of servicing performing loans. These areas include: statements and billings, the technology infrastructure that supports all loans, and the costs of quality assurance, record retention, corporate compliance, and risk management. These all increase the expense of servicing loans.

For Non-Performing Loans

- Base Cost Increases: A major driver for the increased cost of non-performing loans involves the increase in base operating costs, which are now spread across fewer loans than they were in previous years, increasing the cost per loan.

- Default Management Activities: The increased cost is also due to additional costs related to collections, loss mitigation, bankruptcy, foreclosure, and post-sale activities. These activities, which are specific to non-performing loans, add significant expense.

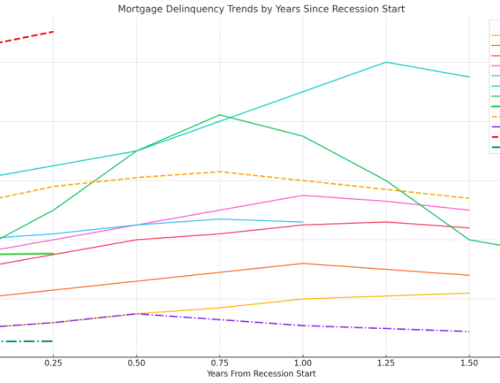

- Post-Pandemic Impacts: The increase in default management activities is partly due to the post-forbearance environment, which required additional workout activities, and the lift of the federal foreclosure moratorium, which put pressure on default departments to ensure investor and regulatory compliance. The cost increase is exacerbated as these costs are distributed across a smaller number of non-performing loans due to lower default rates than 2020-2021.

Departments Impacting Mortgage Servicing Costs

Multiple departments within financial institutions contribute to servicing expenses. Below is a snapshot of their roles and cost drivers:

| Department | Key Responsibilities | Cost Drivers |

|---|---|---|

| Loan Administration | Payment processing, loan account updates, escrow management (taxes and insurance) | Personnel costs, software fees |

| Customer Service | Borrower inquiries and complaint resolution | Personnel costs, call center infrastructure, CRM software, training |

| Default Management | Managing delinquent loans, loss mitigation, and foreclosure processes. | Personnel costs (specialized staff), legal fees (foreclosures, bankruptcies), property preservation expenses, workout program implementation, loss mitigation tools, REO management. |

| Compliance | Ensuring adherence to federal, state, and local regulations, audits, and regulatory reporting. | Personnel costs for compliance officers, cost of compliance software, audit fees, training, implementation of new regulations, regulatory penalties, and reporting costs. |

| Technology and IT | Managing mortgage servicing systems, integrations, cybersecurity, and data management. | Software and hardware costs, system maintenance fees, data storage costs, cybersecurity measures (firewalls, security tools), personnel costs for IT specialists, upgrades. |

| Quality Assurance | Monitoring and ensuring the accuracy of servicing processes and compliance adherence. | Personnel costs for QA staff, quality monitoring software, audit tools, data analysis systems, process reviews, training for staff on quality control, and remediation efforts. |

| Training and Development | Providing ongoing training for staff to stay updated on regulations, systems, and customer service protocols. | Personnel costs for training staff |

The Productivity Challenge

Declining productivity compounds cost pressures, creating a dual threat for financial institutions. According to the MBA’s Servicing Operations Study, the number of loans serviced per employee plummeted from 811 in 2020 to 723 in 2021, a stark indicator of eroding efficiency. This downward trend is driven by three interconnected factors that disrupt workflows, strain resources, and amplify operational costs.

-

Regulatory Backlogs:

Post-2008 financial reforms, such as the Dodd-Frank Act, and evolving state-level compliance requirements have layered complexity onto servicing workflows. Teams now spend disproportionate time navigating documentation, audits, and reporting mandates. For example, a single error in escrow management or payment tracking can trigger hours of corrective work, delaying core tasks like borrower outreach or payment processing. These backlogs create bottlenecks that slow entire departments, reducing output per employee.

- High Turnover: Roles in default management, collections, and foreclosure are inherently high-stress, leading to burnout and attrition. The MBA reports turnover rates exceeding 25% annually in these departments. When experienced staff leave, they take institutional knowledge with them—such as nuanced borrower negotiation strategies or familiarity with legacy systems. Replacing seasoned employees requires costly recruitment cycles, while new hires often take 6–12 months to reach full productivity. This churn creates a cycle of inefficiency, where overburdened teams struggle to maintain service quality amid staffing gaps.

- Training Gaps: The combination of regulatory complexity and high turnover forces institutions to divert resources toward onboarding. New hires in compliance or default management roles require up to 90 days of training to grasp evolving guidelines, proprietary software, and internal protocols. Meanwhile, existing employees must shoulder additional workloads during these transitions, increasing the risk of errors and burnout. For smaller credit unions and community banks, limited training budgets exacerbate the problem, leaving teams underprepared to handle intricate tasks like loss mitigation or foreclosure timelines.

The Ripple Effect

Together, these challenges create a self-reinforcing cycle. Backlogs delay borrower resolutions, escalating default risks and compliance penalties. Turnover and training gaps strain morale, further reducing output. For many institutions, productivity declines of this magnitude can erase 5–7% of annual profits, making cost mitigation strategies not just beneficial but essential for survival.

Four Strategies to Reduce Costs and Boost Efficiency

- Automate Repetitive Tasks: Financial institutions can significantly enhance efficiency by deploying Robotic Process Automation (RPA) to handle repetitive tasks such as payment reminders, compliance checks, and data entry. Automation minimizes human error, accelerates workflows, and allows staff to focus on higher-value activities like borrower engagement and strategic decision-making.

- Embrace Digital Transformation: Modernizing operations through digital tools is critical for staying competitive. Implementing self-service portals empowers borrowers to manage payments, check balances, and upload documents independently, reducing reliance on call centers. Complementing this with AI-driven document processing streamlines tasks like loan file reviews and compliance audits, cutting manual data entry while improving borrower satisfaction.

- Invest in Staff Retention and Training: A stable, skilled workforce is foundational to long-term success. Offering competitive benefits, career development programs, and ongoing compliance training fosters employee loyalty and reduces turnover costs. Well-trained staff are better equipped to handle complex tasks, from navigating regulatory changes to executing loss mitigation strategies, resulting in fewer errors, faster resolutions, and improved service quality

- Partner With Midwest Loan Services, the Best Mortgage Subservicer for Credit Unions and Community Banks: Midwest Loan Services handles high-cost tasks like default management, cutting overhead by 30-40% while ensuring compliance. We can provide access to advanced technologies and expertise that many institutions lack in-house, reducing overhead costs and freeing internal teams to prioritize core competencies like customer relationship management.

The Bottom Line

Rising mortgage servicing costs demand urgent action. For credit unions, community banks, and financial institutions, the path to efficiency lies in embracing automation, digital tools, and strategic partnerships—all while retaining skilled teams. By adopting these strategies, lenders can reclaim profitability, protect margins, and elevate borrower experiences in an increasingly competitive market.

How Midwest Loan Services Can Help

Midwest Loan Services specializes in mortgage subservicing solutions designed to tackle today’s toughest challenges. We reduce costs by up to 40% through streamlined compliance, optimized workflows for default management, and scalable processes for mortgage servicing. Our expertise turns operational burdens into opportunities, empowering lenders to focus on growth instead of paperwork.

Ready to Transform Your Mortgage Servicing?

Contact Midwest Loan Services today for a free cost-saving audit. Discover how our tailored subservicing strategies can future-proof your institution, starting now. Let’s build a leaner, more profitable future—together.

Stay ahead with Midwest Loan Services: Your partner in efficiency, compliance, and growth.