By: Kelly O’Bannon | EVP, Business Development

Date: October 30th, 2024

As a leader in mortgage servicing, Midwest Loan Services is committed to keeping our clients and partners informed about potential industry changes. Recently, the Consumer Financial Protection Bureau (CFPB) proposed new rules aimed at enhancing mortgage assistance processes. The CFPB’s proposal comes in response to ongoing concerns about homeowners facing foreclosure risks during financial hardships, with the goal of making assistance more accessible and effective for borrowers.

For financial institutions including credit union mortgage servicers, the significance of these changes extends beyond individual assistance; it’s about maintaining a healthier loan portfolio, reducing default risks, and strengthening borrower relationships.

The new rules highlight key changes:

- Stop Dual Tracking and Limit Fees – The proposed rules require mortgage servicers and mortgage subservicers to prioritize assisting borrowers before initiating foreclosure. Foreclosure can only proceed once all available assistance options have been fully explored or if the borrower is unresponsive. Additionally, the rules will place caps on the fees subservicers can charge during the assistance review process, aiming to encourage quicker, more equitable handling of borrower requests while reducing financial strain during this critical time.

- Reduce Delays by Streamlining Paperwork Requirements – The proposed rules aim to simplify the process by allowing mortgage servicers to begin reviewing assistance options without requiring a complete application upfront. This adjustment is intended to reduce delays and expedite aid, enabling more homeowners to secure timely modifications and avoid foreclosure. By minimizing paperwork, mortgage subservicers can offer faster relief to those in need.

- Improve Borrower-Servicer Communication – The proposed rules require mortgage subservicers to provide clearer, more personalized notices to borrowers. These notices will contain detailed information about the loan investor and the available assistance options, helping borrowers better understand their choices and the necessary steps. By enhancing communication, borrowers will be better informed and empowered to make well-informed decisions.

- Ensure Borrowers Receive Critical Information in Their Preferred Language – Under the proposed rules, borrowers will have the option to receive assistance communications in the same language as the marketing materials they initially received. The rules also require that key notices be available in both English and Spanish, with oral interpretation services provided for phone interactions. This will make vital support more accessible to borrowers who are not fluent in English, ensuring they receive important information in a language they understand.

Implications for Mortgage Servicers and the Market

While these are currently proposed rules, no immediate action is required. However, at Midwest Loan Services, we believe in staying ahead of the curve. We are actively monitoring these developments and assessing how they may impact our operations and those of our partners.

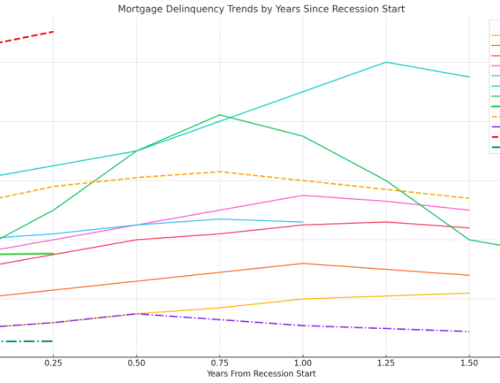

The CFPB’s proposed regulations may lead to changes in how mortgage servicers manage workflows and borrower relationships. These changes could lead to improved responsiveness to borrower needs and foster greater trust and reliability. From a broader perspective, reducing the number of foreclosures helps stabilize property values and local economies, creating a more resilient housing market.

While these rules aim to create a borrower-friendly process, they also pose challenges. Adapting to the new regulatory requirements could require investments in technology and personnel, as institutions update systems to support more flexible documentation and enhanced communication protocols. Servicers might also face challenges in balancing operational costs with the limitations on fees during borrower review processes

From a broader perspective, these changes will have a positive impact on the housing market as a whole. By reducing the number of foreclosures, the proposed rules help stabilize property values and decrease the risk of neighborhood decline. With fewer homes lost to financial distress, property values remain healthier, which in turn supports local economies. This stabilization also prevents the negative ripple effects of widespread foreclosures, such as reduced neighborhood appeal and declining home values. Overall, these regulations aim to foster a more resilient and robust housing market, benefiting homeowners and financial institutions alike by creating a stable and supportive environment for all stakeholders.

In conclusion, the CFPB’s proposed rules present both opportunities and challenges for mortgage servicers. Strategic adjustments will be necessary to enhance borrower support, operational efficiency, and overall compliance, all while contributing to greater stability in the housing market.

For more insights and the latest industry updates, stay tuned for our upcoming articles. Contact us to learn more about how we can assist with navigating the CFPB’s new mortgage servicing rules and enhancing support for your borrowers.